The 2024 Supply Chain Confidence Survey – Key Findings Ahead of the Holiday Season

Discover key highlights from retailers, supply chain leaders, and consumers as they prepare for the upcoming holiday season.

The 2024 Supply Chain Confidence Survey – Key Findings Ahead of the Holiday Season

Key Trends & Strategies Driving Decisions

As the 2024 holiday season approaches, inflation, inventory concerns, and shifting consumer behaviors are shaping how retailers and supply chain leaders prepare. The 2024 Supply Chain Confidence Survey presented by Manhattan Associates reveals the key concerns and strategies driving decision-making during this peak season.

How the Survey Was Conducted

Manhattan Associates’ Supply Chain Confidence Survey was fielded by a third-party provider and conducted from August 23 – September 6, 2024. Responses were collected from 500 management or senior-level officers in retail and supply chain logistics organizations in the United States representing executives that operate stores and online venues in the following sectors: Beauty; Household Goods and Furniture; Consumer Electronics; Healthcare; DIY and Home Improvement; Fashion; Grocery; Sport and Leisure Goods; and Pet Goods.

Additionally, 500 adult (18+ years old) consumers in the United States were surveyed about their sentiments and attitudes going into the 2024 holiday shopping period, plans for purchasing gifts, how they’re spending amid the rising costs of goods, and what retailers should do to earn their business.

Inventory Remains a Concern

Despite preparation, inventory remains a significant source of concern for both retailers and supply chain leaders.

87.2% of retailers have measures in place to ensure trending products are available during peak shopping periods, but 38.8% still cite having enough inventory as their biggest concern.

62.4% of supply chain leaders worry about inventory shortages, while nearly 70% view economic shifts as a larger threat than geopolitical instability or infrastructure issues.

Retailers are mildly concerned about inventory visibility, with 11.2% saying they don’t have enough visibility into their stock levels heading into the holiday season.

Inflation Leads to Caution

93% of consumers say price increases over the past few years have had a moderate or strong negative impact on them.

- Over two-thirds (67.8%) of consumers think that the rate of inflation is getting worse.

70.4% of retail leaders anticipate that holiday costs in 2024 will be higher than in previous years, driven by inflation and rising shipping costs.

Consumers are adjusting their holiday spending: 60% plan to buy fewer gifts, while 57% will seek less expensive options, and 52.2% will look (and are willing to wait) for sales and deals.

Additionally, 74.6% of consumers expect to pay more for their holiday shopping this year compared to last year.

The Rising Cost of Goods and its Impact on Consumers

of consumers

of consumers

of consumers

Making An Investment

Amid a softening labor market, supply chain leaders and retailers are investing more in technology and automation to navigate peak season demands.

43.6% of retailers plan to make fewer seasonal hires this year, with 68.4% considering hiring a non-priority altogether.

In contrast, 58.4% of supply chain leaders plan to increase their workforce to manage peak demand, despite labor constraints.

To make up for fewer seasonal hires, 34.8% of retailers are utilizing automation, while 52.4% of supply chain leaders are investing in improving logistics software.

61.2% of retail leaders reported recent investments in new technologies to improve the efficiency of their supply chain.

Adopting Artificial Intelligence

Retailers and supply chain leaders are leaning into artificial intelligence (AI) to help manage supply chains, forecast demand, and optimize operations during the holiday rush.

60.8% of retail leaders say Generative AI will play a role in their holiday supply chain strategy, with nearly half (49.2%) planning to leverage AI for inventory management.

AI is also playing a role in customer service, with 47.6% of retail and supply chain leaders using AI tools to improve customer interactions and handle inquiries.

Shopping Behaviors Can Change During an Election Year

The upcoming election has cast a shadow of uncertainty over the holiday shopping season, potentially impacting consumer shopping behaviors.

Nearly a quarter of consumers (23%) said they plan to decrease spending if their preferred candidate loses, yet there's a notable generational divide.

- Baby Boomers (aged 65 and older) are more likely to spend less if their preferred candidate doesn’t win the election (29.9%) compared to Millennials (ages 35-44) (12.3%) and Gen X (ages 45-54) (19.8%).

Concerns about post-election conflicts are driving consumers away from traditional shopping experiences. Nearly 20% plan to reduce mall visits, with a preference for online shopping (21.6%) and crowd avoidance (24.8%) emerging as notable alternatives.

If This Sounds Familiar...

Discover a range of Manhattan solutions that can help your supply chain challenges. Need to talk to someone? Chat with us below or fill out our short Contact Us form and we'll get back to you.

Related Content

Manhattan Active Omni

Profitably deliver on the omnichannel customer experience promise with Manhattan Active® Omni - a first-of-its-kind, unified commerce application for modern retail.

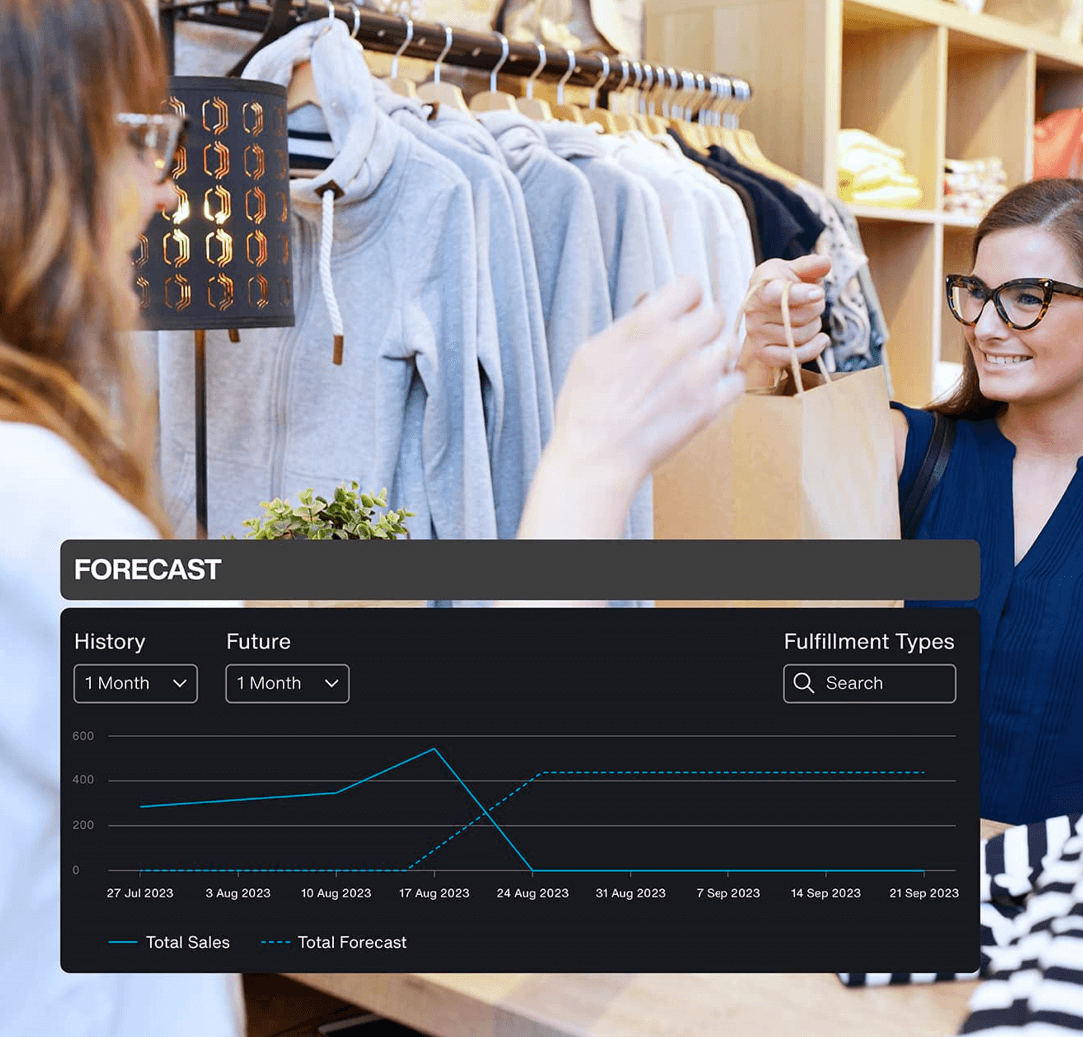

Learn MoreManhattan Active Supply Chain Planning

Manhattan Active® Supply Chain Planning is the only solution to unify demand forecasting, replenishment, and allocation on one cloud-native platform.

Learn MoreManhattan Active Maven

Manhattan Active® Maven for Customer Service is revolutionizing retail GenAI chatbot capabilities with fast, personalized, and highly capable assistance.

Learn MoreCustomer Success

Discover how retailer Michaels used Manhattan technology to optimize omnichannel performance through its digital sales channels and store fulfillment capabilities.

Watch the Video